FDIC-Insured - Backed by the full faith and credit of the U.S. Government

FDIC-Insured - Backed by the full faith and credit of the U.S. GovernmentChecking Accounts

Quarter Back®Earn $0.25 for every debit card transaction of $25 or more1 Open Online

| PayBackSMRefunds on the ATM fees other banks charge up to $15/month2 Open Online

| My PaySM - Student BankingEarn refunds on ATM fees and cash back on debit purchases3 Open Online

| BankSmartNo overdraft fees4 Open Online

| |

| Minimum balance | $0 | $0 | $0 | $0 |

| Monthly maintenance service charge | $0 | $0 | $0 | $3.955 |

| Minimum opening deposit | $25 | $25 | $25 | $25 |

| Statements6 | Free eStatements $2 paper | Free eStatements $2 paper | Free eStatements $2 paper | Free eStatements $2 paper |

Liberty Bank Debit Mastercard®

Your Debit Mastercard allows you to:

*Certain restrictions apply. For details, visit mastercard.com/zeroliability.

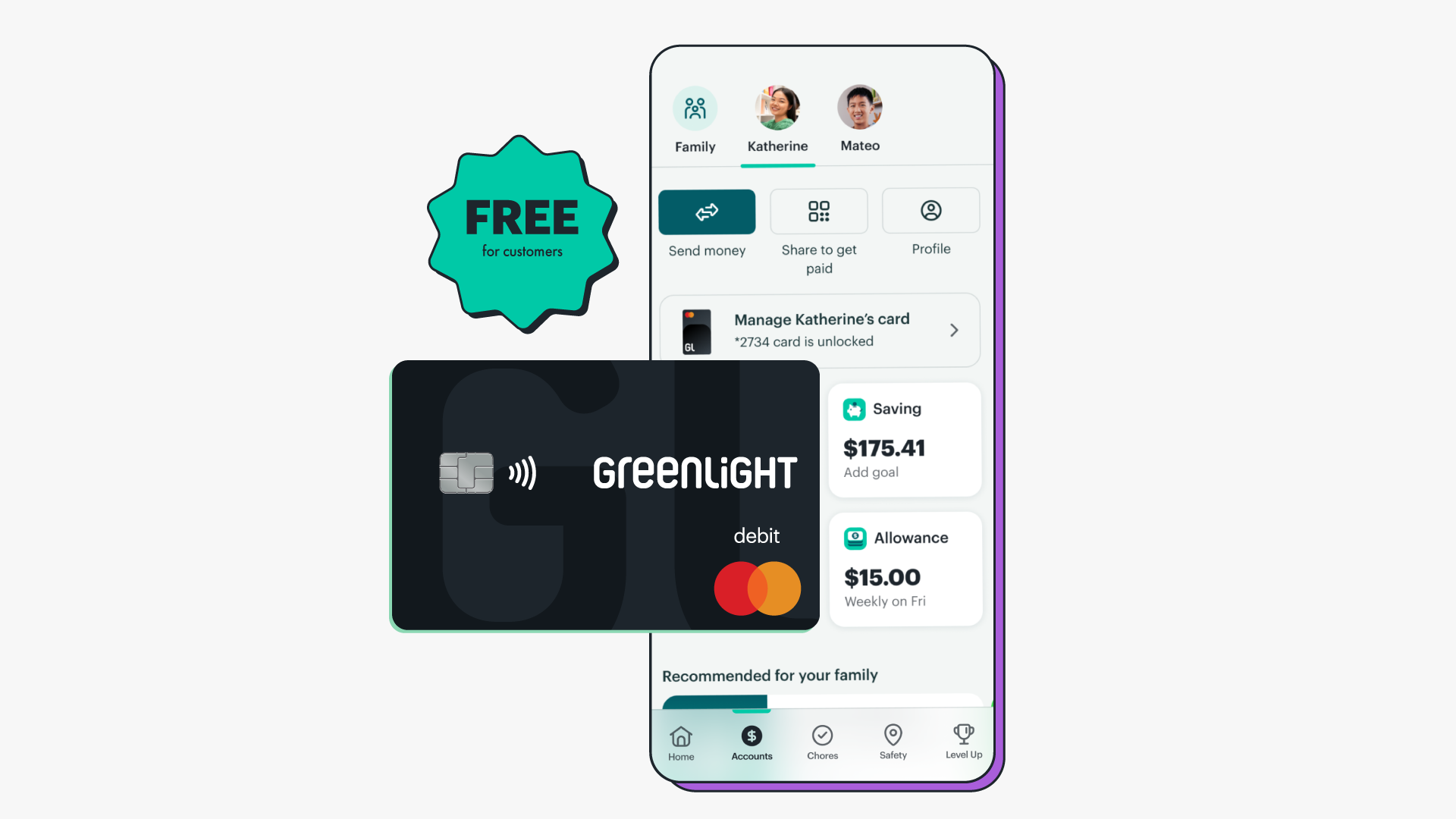

Enjoy Greenlight, the

debit card for kids

Teach your kids to earn, save and spend wisely with a Greenlight debit card. Liberty Bank customers can enjoy Greenlight for free!*

Learn More

How Can We Help You?

Disclosures

If the account holder is under the age of 18, the account must be joint with a parent or guardian.

- Quarter Back® Checking rebates $0.25 for each qualified transaction that posts within the statement period. Qualified transactions are debit card purchases of $25 or more. ATM transactions do not qualify. Rebates post on last day of statement period while account is open and are labeled as “Cash Rewards.” May be subject to 1099 reporting. Fees may reduce earnings.

- PayBackSM Checking automatically refunds up to $15 in ATM surcharges imposed by other banks per statement period, in the statement period that fee was incurred, while the account is open. Rebates are labeled as “ATM Surcharge Rebate” on the statement.

- My PaySM - Student Banking primary account owner must be between 16 and 25 years of age. At age 25, the account may be changed to a different Liberty Bank checking account. Account automatically refunds up to $10 in ATM surcharges imposed by other banks per statement period, in the statement period that fee was incurred, while the account is open. Rebates are labeled as “ATM Surcharge Rebate” on the statement. Earn $0.10 for every debit card transaction of $10 or more that posts within the statement period, up to $10 per statement period. ATM transactions do not qualify. Rebates post on last day of statement period while account is open and are labeled as “Cash Rewards.” May be subject to 1099 reporting. Fees may reduce earnings.

- Liberty Bank will decline or return transactions when there is not enough money in the BankSmart Account to cover the charge. While this account prevents you from overdrawing in most cases, there may still be times when your account could have a negative balance. This could happen if a transaction is approved for one amount, but the actual charge is more than the amount of money in your account. For example, when a tip is added at a restaurant after the transaction for the meal has already been approved. In this situation, the full payment may go through and result in a negative balance on your account, but Liberty Bank will not charge you an overdraft fee. Checks will not be issued for this account and it cannot be linked to an overdraft savings or overdraft protection line of credit.

- Monthly maintenance service charge will be waived if any account owner is 26 and under or 65 and over.

- Avoid $2 monthly paper statement fee with eStatements. Account owners age 65 or over, Individual Development Accounts, Health Savings Accounts, IRA Money Market Fund, and Lease Security - Tenant are exempt.

Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated.

Apple Pay is a trademark of Apple Inc., registered in the U.S. and other countries. Samsung Pay is a registered trademark of Samsung Electronics Co., Ltd. Google Pay is a trademark of Google LLC.

For J.D. Power 2025 award information, visit jdpower.com/awards.